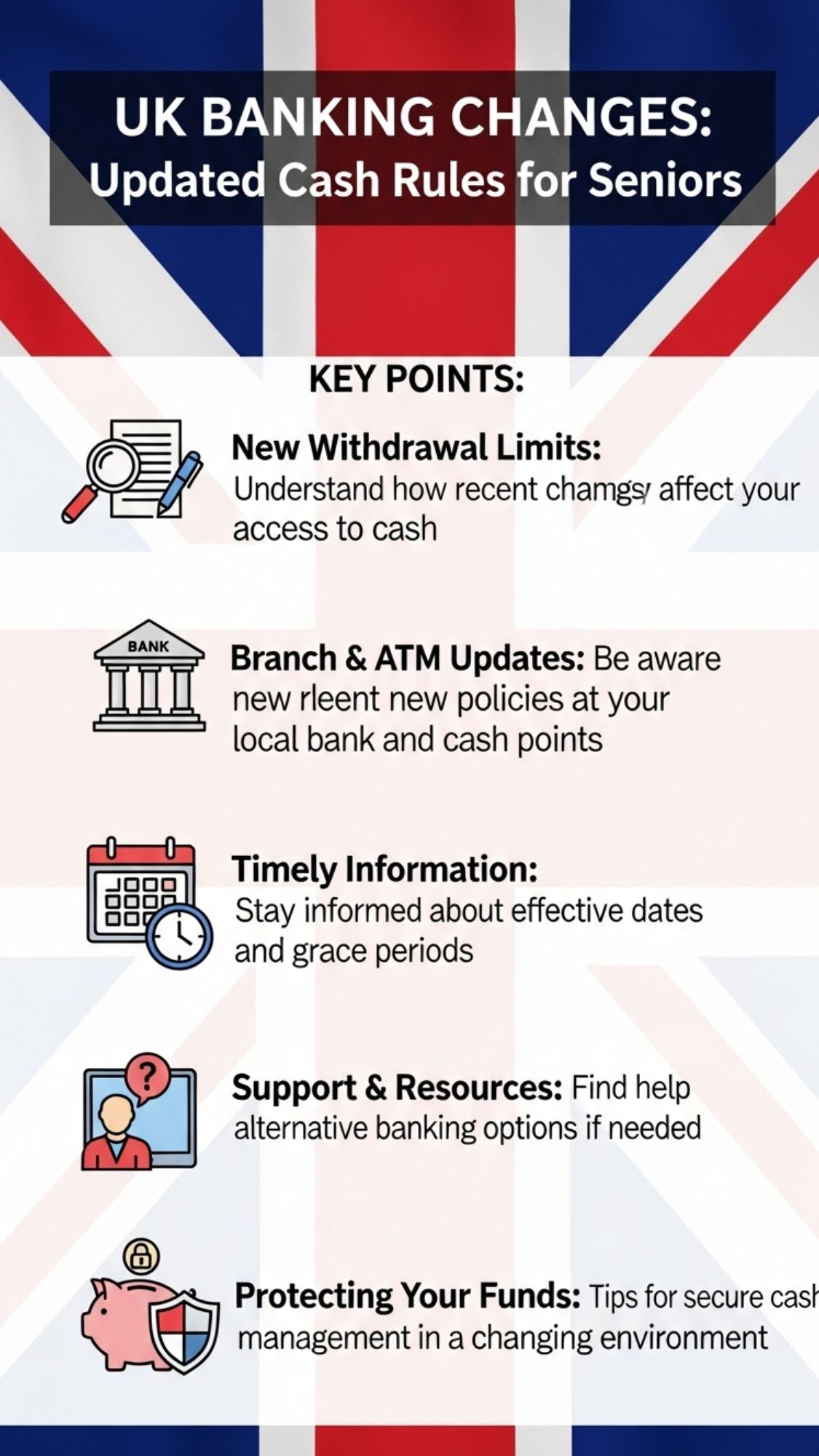

UK banking customers who are 60 or older are experiencing notable changes to their daily cash withdrawal amounts. The main high street banks have revised their withdrawal policies and introduced new daily limits along with extra security measures that focus on protecting older customers. These updates that start today aim to balance ease of use with fraud protection during a period when financial scams targeting pensioners are increasing rapidly throughout the UK. For many people over 60 access to cash continues to be an important part of daily life. Whether paying household bills or shopping locally or helping family members the daily withdrawal limits can directly affect financial freedom. It is important to understand what has changed & why it matters & how to handle your money under the new rules. What follows is a complete and easy-to-understand guide about the new withdrawal limits for people over 60 & what UK banks are confirming & how these changes might affect your daily banking.

Why UK Banks Are Tightening Cash Access for Senior Customers

Banks across the UK are facing increasing pressure to put stronger safeguards in place for older customers. In recent years, there has been a sharp rise in fraud cases affecting pensioners, with criminals deliberately targeting individuals who depend more on cash withdrawals and telephone banking services.

The introduction of new withdrawal limits is driven by three key objectives:

– To help prevent sudden and significant cash losses linked to scam activity

UK £600 DWP Cost of Living Relief for 2025 : New Rules, Full Schedule and Other Details Here

UK £600 DWP Cost of Living Relief for 2025 : New Rules, Full Schedule and Other Details Here

– To enhance monitoring of transactions involving customers who may be vulnerable

– To give banks additional time to identify and stop suspicious behaviour

Statistics show that people aged over 60 are more likely to withdraw large sums in a single transaction, often to cover home repairs, support family members, or pay for medical needs. This behaviour makes them particularly attractive targets for fraudsters, who frequently create urgency and pressure victims into withdrawing cash quickly.

By reducing standard daily withdrawal limits and introducing extra verification steps for higher amounts, banks aim to add an extra layer of protection while still ensuring customers can access their money when genuinely needed.

Today’s New Cash Withdrawal Limits Explained Clearly

Under newly introduced banking guidelines, a growing number of UK banks are rolling out updated daily cash withdrawal rules that primarily affect customers aged 60 and over.

Although the exact limits differ by bank and account type, the most widely reported updates generally include:

– Lower default daily withdrawal limits at ATMs

– Reduced in-branch cash withdrawal amounts without extra approval

– Additional security checks for high same-day cash withdrawals

– Short delay or holding periods for unusually large cash requests

For instance, customers who were previously able to withdraw between £500 and £1,000 per day from ATMs may now see standard limits reduced to around £300–£500, unless they specifically apply for an increased allowance.

Similarly, larger cash withdrawals made inside bank branches may now prompt further identity verification, safeguarding questions, or a brief waiting period before the funds are made available.

While banks state these changes are intended to protect customers rather than restrict access, they do require people over 60 to plan ahead when they need to withdraw higher amounts of cash.

Which UK Account Holders Over 60 Are Most Affected

These updates mainly affect the following groups:

• Customers aged 60 years and above

• Holders of personal current accounts

• Savings account holders with access to cash withdrawals

• Joint account holders where at least one account holder is over 60

Business accounts are generally excluded from these changes, although individual banks may apply different internal rules.

It is also worth noting that limits may not be reduced immediately for every customer. Many banks are rolling out the changes in phases and may review account activity before enforcing new withdrawal caps.

That said, customers aged 60 and above should assume stricter controls could now be in place and are strongly advised to confirm their current limits directly with their bank.

How ATM Cash Withdrawals Change Under the New Rules

For many pensioners, ATMs remain the most frequently used way to withdraw cash. Under the updated banking rules, ATM usage is one of the key areas seeing changes.

Common updates include:

– Reduced standard daily withdrawal limits

– More frequent security verification steps

– Short-term restrictions after multiple incorrect attempts

– Quicker identification of unusual withdrawal behaviour

If a customer attempts to withdraw an amount significantly higher than their usual pattern, the system may automatically pause or decline the transaction until further checks are carried out.

This does not prevent access to personal funds. Instead, the bank may request confirmation through a text message, a banking app notification, or a direct call from the local branch before allowing the withdrawal.

In-Branch Cash Access: What Seniors Need to Know

Many people aged over 60 continue to prefer withdrawing larger amounts of cash directly from their local bank branch. Under the revised policy, this option is still available, although a number of extra safety checks may now apply.

When requesting higher cash withdrawals, customers could be asked:

• What the funds are intended for

• Whether anyone has encouraged or pressured them to make the withdrawal

• If they have recently received unexpected phone calls, texts, or messages

• To show additional identification, even if they are already familiar to branch staff

Although some may feel these checks are intrusive, they form part of a nationwide effort to combat authorised push payment fraud and cash-related scams.

In situations considered high risk or urgent, banks may also introduce a brief delay before releasing large sums, allowing both customers and staff time to review the request and prevent potential financial harm.

Can Seniors Apply for Higher Withdrawal Allowances?

Customers aged 60 and over can still apply for higher daily withdrawal limits when there is a genuine financial need. Common reasons include:

– Paying for essential home repairs

– Meeting the cost of private medical care

– Assisting with an urgent family situation

– Making a large, one-time purchase

To request a higher limit, customers are usually required to:

– Visit their local bank branch

– Show valid proof of identity

– Clearly explain why the withdrawal is needed

– Confirm they are acting independently and not under pressure

In most situations, banks approve these increases on a temporary basis only. After the required transaction is completed, the account limit generally reverts to its standard setting.

This balanced system helps older customers access their money when necessary, while still reducing the risk of long-term fraud and financial abuse.

Impact on Pensioners Who Rely Mainly on Cash

A large number of UK pensioners continue to depend on cash for their daily expenses. Many local retailers, market stalls, and small service businesses still favour cash payments, particularly in towns and rural areas outside major cities.

With the introduction of new withdrawal limits, some pensioners may need to make small lifestyle changes, such as:

– Withdrawing smaller amounts more often

– Spreading cash withdrawals across multiple days

– Using debit cards for payments where possible

– Monitoring daily withdrawal limits more carefully

For most people, everyday purchases and regular bill payments are expected to remain unaffected. However, individuals who are used to withdrawing larger sums at once for weekly or monthly spending may need to rethink their usual routines.

Banks are advising customers to speak directly with branch staff if the revised limits create genuine hardship, as tailored or temporary arrangements can often be put in place.

How Rising Scam Cases Triggered These Banking Changes

These changes have been introduced in direct response to the growing surge in scam activity targeting older people across the UK. Criminals are now using far more advanced and convincing methods, including:

– Phone calls pretending to be from banks or building societies

– Text messages warning that accounts have been compromised

– Door-to-door frauds pressuring victims to withdraw cash urgently

– Romance scams aimed at elderly and socially isolated individuals

In many situations, victims are persuaded to visit a branch, withdraw large sums of cash, and hand the money over to fraudsters. By slowing down cash withdrawals and adding extra verification steps, banks hope to disrupt these scams at the final and most critical stage—before irreversible financial damage occurs.

As a result, the new withdrawal limits are not simply about controlling cash access; they are designed to protect vulnerable customers at the moment they are most at risk of fraud.

Immediate Steps Over-60s Should Take Right Now

If you are aged 60 or above, taking a few proactive steps now can help you stay informed and avoid any unexpected issues:

– Review your current daily cash withdrawal limit using your banking app, online banking, or by visiting a branch

– Confirm with your bank whether your account is impacted by the updated policy

– Inform your bank in advance if you expect to need a larger cash withdrawal

– Ensure your contact details are accurate and up to date

– Add a trusted contact to your account, if this option is available

Staying prepared can help you avoid delays or inconvenience, especially if you are planning an important purchase or need to make an urgent payment.

Effects on Joint Accounts and Carer-Managed Finances

Joint accounts with one holder aged over 60 might face changes under the new rules based on how the bank categorizes the account. Sometimes the reduced withdrawal limit affects both people on the account. Extra verification steps could be necessary even when the younger person withdraws money. Big withdrawals might prompt the bank to contact both account holders. These changes matter especially for customers who depend on carers or family members to access their accounts. It becomes crucial to have proper legal documentation like a power of attorney in place. Banks now enforce stricter policies about who can withdraw cash and under what circumstances.

Digital Payment Options Banks Are Pushing Seniors Toward

Alongside the introduction of new withdrawal limits, UK banks are increasingly encouraging older customers to move towards digital alternatives instead of relying on cash. These options include:

– Contactless debit card transactions for everyday spending

– Mobile banking apps designed with simplified, easy-to-read layouts

– Telephone banking services for those who prefer speaking to an advisor

– Direct debit arrangements for paying regular household bills

Although many people aged over 60 remain cautious about digital banking, simple card payments are widely considered safer than carrying large sums of cash and are less appealing to criminals.

To support this shift, banks are investing heavily in dedicated customer assistance, helping older customers gain confidence and feel more comfortable using these digital banking options.

How the Public and Senior Groups Are Reacting

The reaction from people over 60 has been mixed. Some appreciate the added protection particularly those who have faced scam attempts or know someone who lost money. Others feel the new rules restrict their financial independence & unfairly assume they are vulnerable simply because of their age. Consumer groups have emphasized that protective measures should not become paternalistic or too restrictive. UK banks say the changes are being applied flexibly & that no customer should be prevented from accessing their own money without good reason. However the balance between protection and personal freedom remains a sensitive issue.