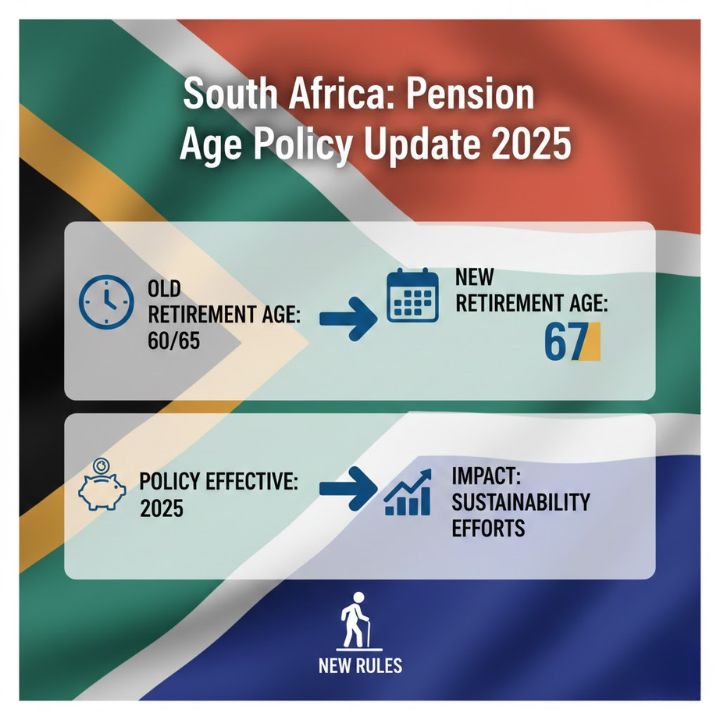

South Africa has updated its retirement regulations for 2025 with changes that impact retirement timing & benefit access. The government has increased the official retirement age from 65 to 67 & modified pension fund access rules along with social grant eligibility criteria. These updates matter for anyone preparing for retirement or assisting elderly relatives. They establish when employment can end and which financial assistance programs may be available. Knowing about these changes helps South Africans plan more effectively for their later years.

South Africa’s Bold 2025 Pension Shift — What’s Changing in the New Retirement Age?

| Feature | Revised Retirement Framework (2025) |

|---|---|

| Official Retirement Age | New national retirement age increased from 65 to 67 years |

| Early Retirement Provision | Retirement allowed from age 60, with proportionately reduced benefits |

| Pension Fund Access | Withdrawals permitted only at the updated retirement age or in exceptional approved cases |

| Social Grant Eligibility | Eligibility threshold modified to match the revised retirement age rules |

| Tax Rule Adjustments | Expected updates to contribution and withdrawal tax regulations for 2025 |

| Employer Obligations | Employers must revise pension schemes and formally inform employees of the new standards |

| Impact on Personal Savings | Individuals encouraged to reassess long-term financial plans and retirement savings strategies |

| Old Age Grant | Grant structure updated to synchronize with the increased retirement age |

Why the Government Is Pushing Retirement Beyond 67 — The Core Policy Drivers

South Africans are living longer now and that brings good news. But this longer life expectancy puts extra pressure on the pension system. The government wants to increase the retirement age to 67 for several key reasons.

– First it keeps pension funds financially healthy in the long run.

– Second it allows people to work and earn money for additional years.

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

– Third it eases the strain on the national budget.

This shift means you need to rethink your retirement strategy. You should decide when you truly want to stop working and figure out how much money you need to save for your retirement years.

Early Exit at 60 in 2025 — Eligibility, Risks, and Smart Decision Factors

You can still retire at 60 but your benefits will be lower. The reason is that payouts need to stretch over more years when you stop working early.

– Early retirement usually works best for people who have strong personal savings.

– It also suits those who have investments that generate stable income.

– Some people are unable to work until 67 or simply prefer not to continue working that long.

If you are thinking about retiring early it helps to talk with a financial advisor. They can explain how this choice will affect your finances over the long term.

How the Revised Retirement Age Reshapes Social Grants and Pension Fund Payouts

Social grants like the Old Age Grant now match the new retirement age. This means many South Africans must wait two extra years before qualifying. Pension fund rules may also shift in multiple ways. Changes will affect when you can withdraw money & how much tax you pay.

Employer schemes might need adjustments to meet the new requirements.

If you pay into a retirement annuity or an employer pension fund you should review your portfolio now.

Knowing how these changes impact your retirement planning helps you make smarter financial choices for the years ahead.

Essential 2025 Pension Reforms Every Citizen Needs to Track Closely

What You Need to Know As We Move Into 2025 Several important changes are taking effect as we enter 2025.

Adjusting Your Savings Plan — How to Future-Proof Your Retirement Strategy

You should think about changing how much money you put toward retirement so you will have enough funds to live well after you finish working.

New Tax Rules for Retirees in 2025 — Key Deductions, Penalties, and Reliefs

Tax regulations undergo modifications over time and these changes can influence how much money you owe when you withdraw funds from your financial accounts.

What Employers Must Prepare For Under the Updated Retirement Age Policy

Companies need to update their pension plans and make sure employees understand the changes.

Starting this process early helps everything go more smoothly and keeps your financial future secure.

South Africa’s Pension Future — What the 2025 Policy Means for Workers and Retirees

South Africa’s 2025 retirement reform brings significant changes to how people organize their careers. The new policy means many citizens must work longer than earlier generations did.

This change also opens doors to build stronger financial security for later years. The reform impacts different age groups in distinct ways. Workers who are close to retirement age now must make quick decisions about their future plans.