The GST Voucher Scheme has become something many Singaporeans depend on, particularly as prices rise across the island. Most people see it as a yearly bonus, but this support program has actually been running continuously since Budget 2012. The purpose is straightforward. As GST increases the government aims to ensure that lower-income households are not hit the hardest by rising costs.

GSTV 2026 Breakdown: Updated Overview of All Support Components

| GSTV Component | Who It Helps | What It Covers | Payout Schedule |

|---|---|---|---|

| GSTV-Cash | Lower-income individuals and households | Direct cash assistance to help meet everyday expenses and essentials | Annually — disbursed in December |

| GSTV-MediSave | Singaporeans aged 65 and above | Top-ups into MediSave accounts to offset healthcare costs | Annually — disbursed in December |

| GSTV-U-Save | Eligible HDB households | Quarterly bill credits to offset utilities (electricity, gas, water) | Quarterly — January, April, July, October |

| GSTV S&CC Rebate | Eligible HDB households | Rebate to offset conservancy and town council (S&CC) charges | Quarterly — January, April, July, October |

Purpose of the GST Voucher: Why Singapore Provides This Annual Support

We have all heard this before. Singapore’s tax system uses a progressive model. Higher-income households pay much more into the system. The top 20% contribute about 80% of all income tax. But GST works differently. Whether you buy kopi at a Kopitiam or groceries at FairPrice, everyone pays the same GST rate. This is why GST can hit lower-income groups harder. To reduce that impact, the government introduced temporary GST offsets in 2007. By 2012 these became the permanent GST Voucher Scheme. This ensured that GST would not unfairly affect families already managing tight budgets. The scheme now has four parts. These are Cash, MediSave, U-Save and S&CC rebates. Each part targets specific household needs.

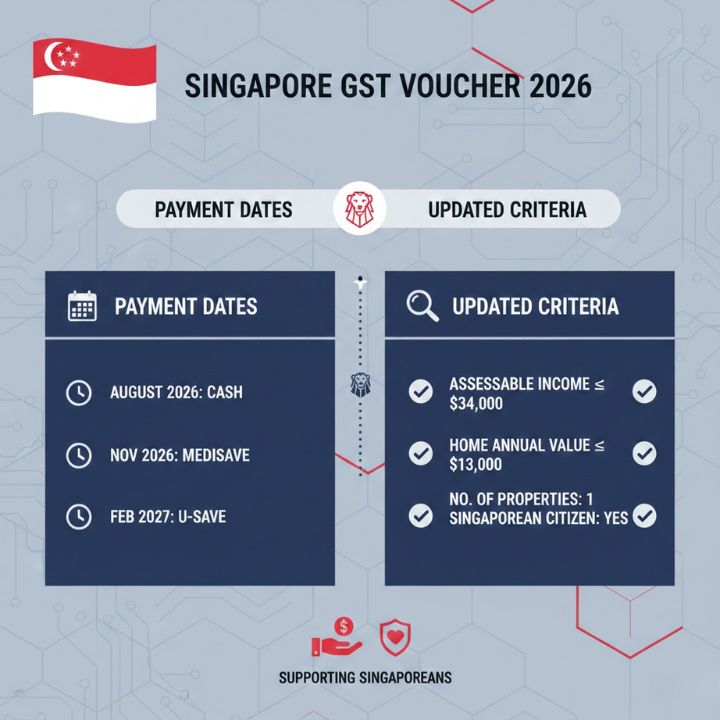

GSTV-Cash 2026: Direct Financial Relief for Everyday Household Expenses

Cash remains the most direct form of assistance and GSTV-Cash provides that financial relief. Payments are distributed each December and typically arrive through PayNow-NRIC. Who Can Receive GSTV-Cash in 2025 You need to meet these requirements: Hold Singapore citizenship and reside in Singapore Be at least 21 years old Have Assessable Income for YA 2024 of $34,000 or less Reside in a property with an Annual Value of $31,000 or below as of 31 December 2024 Own no more than one property The AV limits were increased starting from 1 January 2025. Here is how the payment structure works: Properties with AV below $21000 receive $850 Properties with AV between $21,000 and $31,000 receive $450 This change allows more households across Singapore to qualify for assistance. Residents in established estates like Ang Mo Kio and newer developments in Punggol can now benefit from the program.

GSTV-MediSave Boost 2026: Enhanced Medical Savings for Singapore Seniors

Medical bills can pile up and this part of the program helps older Singaporeans add money to their MediSave accounts automatically in December

. Who Can Get GSTV-MediSave in 2025 You need to be a Singapore citizen living in Singapore and be 65 years old or older in 2025. Your home must have an annual value of $31000 or less and you cannot own more than one property. Income does not matter for this benefit so even retired seniors without any earnings can receive the top-up.

MediSave Top-Up Rates for 2025: Age-Wise Updated Contribution Amounts

| Age Group (Year 2025) | Annual Value ≤ $21,000 | Annual Value $21,000–$31,000 |

|---|---|---|

| 65–74 Years | $280 | $170 |

| 75–84 Years | $380 | $270 |

| 85+ Years | $480 | $360 |

GSTV-U-Save 2026: Quarterly Utilities Rebate to Ease Power & Water Bills

Electricity & water bills are a regular expense and when prices change every dollar matters. GSTV-U-Save gives you rebates four times a year that go straight into your SP Services utilities account. Who Qualifies for U-Save You can get this rebate if you live in an HDB flat & there is at least one Singapore citizen who owns or lives in the unit. Your household must not own more than one property. People who rent entire units can also qualify as long as one tenant is a Singapore citizen. Any rebate you don’t use carries forward automatically. This means if your bill is low one month the remaining balance will help pay for your bills later.

GSTV S&CC Rebate 2026: Monthly Conservancy Charge Relief for HDB Residents

Service and Conservancy Charges may not seem exciting but they are a regular expense for everyone living in HDB flats. The GSTV-S&CC Rebate exists to help reduce this ongoing cost. The government distributes this rebate four times each year. Residents receive payments in January, April July & October.

Who Qualifies for the S&CC Rebate 2025: Updated Eligibility Criteria

You must meet these requirements:

– Have at least one Singapore citizen who owns and lives in the flat Not own any private property Not rent out the entire flat Households usually receive between 1.5 and 3.5 months of rebates each year.

– For 2025 the government included an additional 0.5-month rebate in January that was announced in Budget 2024.