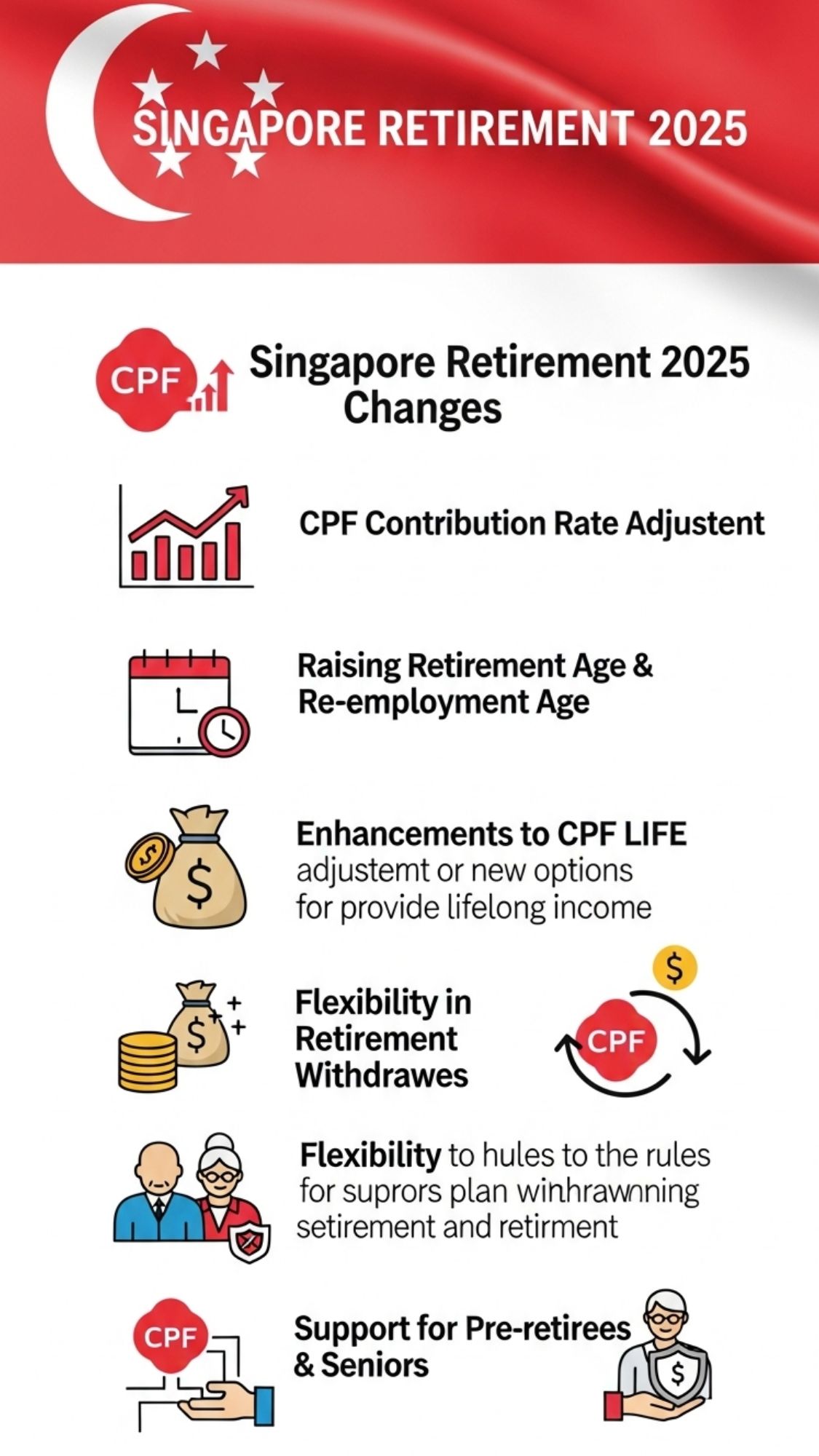

Picture yourself drinking coffee in the morning sunshine without any worries. This is what many locals imagine their retirement will look like. However the CPF system is changing in 2025 & these changes will affect both retirement dreams and how senior citizens earn their income. The practicality of this change is worth considering. People who are planning their finances need to understand that the new CPF policy will likely mean working for more years before retirement.

Age Of Opportunity Extending Work And Wisdom

The Singapore working population gains valuable experience over time. From December 20 the retirement age increases to 64 and re-employment extends until age 69. This represents more than just a number change as it allows older workers to continue finding purpose in their careers beyond 60. The public sector will implement this change first & set an example for private companies to follow. By 2030 the standard ages will reach 65 and 70. Companies are recognizing the value that experienced workers bring to their organizations. One older worker mentioned that he enjoys passing on his knowledge to younger colleagues while also earning additional income. With the rising retirement age older employees are becoming valuable contributors to workplace innovation rather than being seen as a burden.

Savings Surge CPF Sums Climb Higher

The CPF retirement scheme stands at the center of retirement changes coming in 2025. The Basic Retirement Sum (BRS) will increase to SGD 105,000 while the Full Retirement Sum (FRS) will reach SGD 210000. These adjustments reflect rising costs of living and healthcare expenses. When members turn fifty-five their accounts will transition into a Retirement Account designed for clearer payout structures. The Enhanced Retirement Sum (ERS) will now equal four times the BRS and provide access to higher annuity payments through CPF LIFE. This means retirees can look forward to more travel opportunities & quality time with grandchildren beyond just meeting basic needs.

Contribution Boost Building Wealth Together

Seniors will see their savings accounts grow more starting December 20, 2025 because CPF interest rates are increasing for people aged 55 to 65. The rates will rise by 1.5% with employers contributing an additional 0.5% and employees adding 1%. The monthly wage ceiling is currently set at SGD 7400 and will increase to SGD 8,000 by 2026. These changes work together to boost growth in both Ordinary and Special Accounts. People who started saving later or took career breaks will benefit the most from this change because their interest will compound over time. The Senior Employment Credit will help employers cover the additional costs and make the transition smoother. The higher contributions being made now will lead to more secure & comfortable retirement years ahead.

How to Claim Singapore CDC Vouchers worth $500? Check Step by Step Process and Eligibility Criteria

How to Claim Singapore CDC Vouchers worth $500? Check Step by Step Process and Eligibility Criteria

Payout Power-Up Monthly Cash Flow Rises

The CPF LIFE program in Singapore will receive an upgrade in 2025 to provide better monthly payments while maintaining its lifelong income guarantee. The new payout rates are expected to reach SGD 900-1000 monthly for Basic Retirement Sum members, SGD 1800-2000 for Full Retirement Sum members and SGD 2600-2800 for Enhanced Retirement Sum members. Self-employed workers will benefit from new quarterly MediSave rebates ranging from SGD 200-400 starting in 2025. The rebates will be calculated based on their contribution amounts. Low-income seniors aged 65 and above will see their Silver Support Scheme benefits increase by 20 percent. The Matched Retirement Savings Scheme will also extend its coverage to individuals up to age 70. These programs provide essential support structures that help retirees manage their expenses during periods of rising inflation.

Inclusive Nets Covering Freelancers And Low-Earners

Self-employed individuals who have been overlooked will now receive proper attention. The required MediSave contributions will ensure personalized payouts designed to promote fairness. Part-time workers and those in the gig economy can finally establish their own financial safety nets. Top-up grants are available to help everyone increase their savings. Counseling services & mobile applications will simplify the planning process and enable better decision-making.

| Retirement Tier | 2024 Sum (SGD) | 2025 Sum (SGD) | Primary Advantage |

|---|---|---|---|

| Basic Retirement Sum (BRS) | 99,400 | 105,000 | Meets essential needs without relying on property pledge |

| Full Retirement Sum (FRS) | 198,800 | 210,000 | Provides a stable annuity foundation for long-term balance |

| Enhanced Retirement Sum (ERS) | 298,200 | 420,000 | Delivers higher monthly payouts for stronger retirement security |

Charting Your Path Action Steps Ahead

Do not wait for these reforms to happen on their own. Take action and make the most of them. Consider making a top-up contribution to receive the available grants. If you choose to delay your payments until age 70 you will receive a 10% boost to your credit. Visit the CPF portals today to explore your options. Review your CPF statement once every three months to stay informed about your account. Discuss re-employment opportunities with your employer well before your current contract ends. Consider making top-up contributions for your family members to help them build their retirement savings. Attend the free seminars that explain the different LIFE plan options available to you.