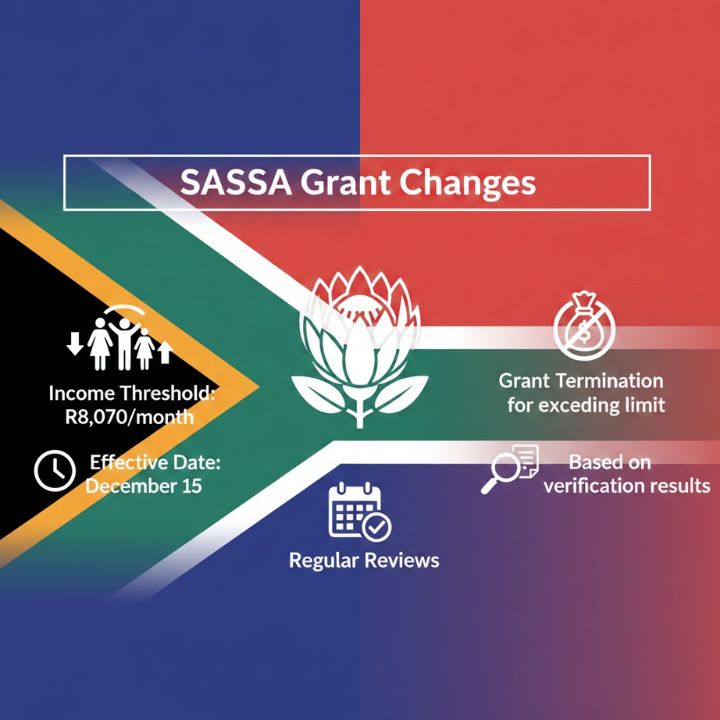

The South African Social Security Agency (SASSA) has announced a significant deadline that will affect numerous families across South Africa. The agency will discontinue grant payments to families with monthly earnings exceeding R8070 by December 15. This measure forms part of a broader initiative to enhance the social assistance system and ensure resources reach those who genuinely require support. The adjustment holds considerable significance for many households that rely on this financial aid amid challenging economic conditions in the nation. SASSA is implementing these changes to align social welfare programs with present economic realities and guarantee assistance reaches the most vulnerable citizens. Families whose income surpasses the threshold should begin exploring alternative financial management strategies before the deadline.

December 15 Explained: Why SASSA Is Ending Grants for Households Earning Above R8,070

The South African Social Security Agency has introduced a new policy that will end payments for families who earn more than R8070 each month. This marks a significant shift in the way the agency manages social welfare funding across the country. The main goal behind this decision is to use available resources more efficiently by channeling them toward families who are struggling the most financially. SASSA wants to make sure that financial assistance goes to the poorest households instead of being distributed among families with relatively higher incomes. The agency thinks this strategy will help the social grant system remain viable in the long run. By concentrating on lower-income families the organization aims to tackle poverty more successfully and ensure that vulnerable people receive the support they need.

– The policy is designed to achieve multiple goals, not just to reduce the number of beneficiaries.

– It aims to align social welfare support with present economic realities, while safeguarding grant sustainability for future generations.

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

– SASSA expects households earning above the set income limit to move toward greater financial self-reliance instead of depending on state aid.

– The approach prioritizes assistance for individuals and families experiencing the most severe financial hardship.

– By restricting grants to those below the income threshold, the agency believes it can build a more equitable system that focuses resources on South Africa’s most vulnerable communities.

Overall, the change represents a move to manage public funds more responsibly while continuing to protect those who are unable to cope without government support.

Financial Shock Ahead: How the New SASSA Income Cutoff Will Impact Families

SASSA Payment Changes and Their Effects on South African Households The decision to stop payments will affect many South African families who currently receive social grants. People who earn slightly more than R8070 may face financial uncertainty because of this change. Families who are affected need to look for other ways to manage their money. When the payments stop households will need to review their budgets and decide what their financial priorities should be. However this change might also help reduce how much wealthier families depend on government support. It could push them to become more self-reliant and financially independent. SASSA’s new policy is a signal for families to rethink how they handle their finances as economic conditions change. The adjustment means that households must adapt to new circumstances & find alternative income sources. This shift in policy aims to ensure that government assistance reaches those who need it most while encouraging others to pursue financial stability through their own means.

| Income Bracket | Expected Impact | Required Step | Likely Result |

|---|---|---|---|

| Below R8,070 | Uninterrupted SASSA benefits | No action needed currently | Regular grant payments continue |

| R8,070 – R10,000 | Possible pause in grant | Review income & expenses | Reduced dependency on support |

| Above R10,000 | Grant eligibility removed | Explore new financial options | Shift toward self-managed income |

Before the Block: Essential Steps Families Must Take Ahead of the SASSA Review

Families affected by SASSA payment changes should prepare themselves before the December 15 deadline. These households need to review their financial situation and consider alternative income sources. Proper preparation involves understanding what the policy change means & how it will impact them. Families must assess their current finances and identify areas where they can reduce expenses. They should also explore opportunities to generate additional income. Consulting with a financial advisor might prove helpful during this transition period. This situation offers families an opportunity to improve their money management skills and utilize their resources to maintain financial stability after SASSA payments end.

– Begin by reviewing your existing financial plan.

– Explore multiple options to generate additional income.

– Evaluate your expenses and identify areas to reduce costs.

– Seek guidance from financial experts or advisors.

– Search for new opportunities to increase your earnings.

After the Deadline: Immediate Actions to Take Once SASSA Payments Stop

Families affected by SASSA’s payment suspension should take practical steps to manage the policy change. Begin by understanding what the new policy involves and how it impacts your monthly finances. Reach out to SASSA offices to get specific information and guidance about your case. Focus on building your financial knowledge by learning essential skills such as budgeting and saving strategies. Explore community resources and local support groups that offer assistance during this transition.

– These actions can help households limit the impact of the new policy and develop stronger long-term financial habits.

– Understand how the updated policy affects you by getting accurate guidance.

– Contact SASSA directly to receive clear, official information.

– Prioritise learning practical budgeting and saving techniques.

– Look for nearby community programmes that provide financial or skills support.

– Use this transition period to strengthen everyday money-management habits.

Beyond Grants: Community and NGO Support Options for Affected Families

Community support programs play a vital role for families facing interrupted SASSA payments. These initiatives provide additional assistance & networks that help families navigate financial challenges more effectively. Local community centers & non-profit organizations typically offer programs focused on financial literacy and job training alongside other valuable services. By participating in these programs families can develop practical skills and access resources to improve their economic circumstances. Affected families should actively seek out these community resources and incorporate them into their overall adaptation strategy.

– Financial literacy programs teach people about money management.

– Job training & employment services help people find work & learn new skills.

– Access to financial advisors gives families expert advice on handling their finances.

– Community support groups let families connect with others facing similar challenges and share experiences.

Life After SASSA: Practical Income Options to Replace Lost Grant Support

Finding Other Ways to Earn Money During SASSA Payment Delays When SASSA payments get delayed families need to find other income sources. South Africa offers several options for people wanting to earn extra money. Starting a small business is one possibility. Looking for freelance work or part-time jobs is another option. The internet has created opportunities for online services & remote work that people can do from home. Families should consider their skills and interests when choosing how to earn money. This makes it easier to find suitable income opportunities. Having multiple income streams reduces dependence on social grants. This strategy helps families create better financial security for their future.

– Apni skills aur interests ka clearly assessment karein taake strengths samajh aa sakein.

– Apni abilities ke mutabiq kisi chhote business ya side venture ka option explore karein.

– Apne area mein freelance work ya part-time job ke mauqe actively search karein.

– Online platforms ka use karke remote work ya digital services offer karne ke tareeqe dhoondein.

– Multiple income sources par based ek practical earning plan tayar karein taake stability ban sake.

Surviving the Shift: Budgeting Strategies for Households Without SASSA Aid

Building a strong financial plan is essential for families who are transitioning away from SASSA assistance. Financial planning involves setting clear money goals and creating a budget that prioritizes saving. Families should focus on their long-term financial stability by building an emergency fund and planning for future expenses. A good starting point is to track all income & spending to understand where money goes each month. This helps identify areas where costs can be reduced & savings can grow. Even small amounts saved regularly can add up over time and provide a safety net during difficult periods. Setting realistic financial goals gives families something to work toward. These goals might include saving for children’s education or building a fund for unexpected medical costs.

– Using helpful tools like budgeting apps and attending financial workshops can make reaching these targets easier.

– When families stick to good money habits they can move toward lasting independence and stable finances.

– Decide what you want to achieve with your money

– Make a detailed budget Put savings first & set aside emergency money

– Use budgeting tools and learning resources Stick to good money habits

Bigger Picture: How SASSA’s New Income Rules Could Reshape Local Economies

The financial impact of SASSA’s payment system plays a crucial role for both household budgets and the broader South African economy. This approach aims to lift people out of poverty & stimulate economic development by directing funds toward the most vulnerable populations. However families who lose their benefits after their income increases often struggle financially and reduce their spending on essential items. The success of this system over time hinges on whether these households can adapt effectively and discover alternative income sources. Understanding these financial consequences is essential for both government officials and families to navigate this shift smoothly.

| Economic Factor | Key Influence | Expected Results |

|---|---|---|

| Poverty Reduction | Focused benefit distribution | Stronger protection for low-income households |

| Consumer Spending | Fluctuation in daily expenditure | Possible slowdown in retail and service sectors |

| Employment Market | Higher need for work opportunities | New job openings and sector expansion |

| Household Financial Stability | Improved income security for struggling families | Greater economic resilience across communities |

| Long-Term Economic Growth | Depends on successful policy adaptation | Stronger and sustainable national development |

Guidance That Matters: Expert Advice for Families Hit by the December 15 Cutoff

Navigating SASSA Payment Changes: A Practical Guide for Families Families dealing with SASSA payment changes need to take practical steps to handle this shift successfully. The first priority is to understand exactly what the policy means and how it will affect your household finances. You can get helpful information by talking directly with SASSA representatives or consulting with financial advisors who know the system. The second important step is to look for other ways to earn money. Relying only on social grants can be risky when policies change. Think about different financial approaches that could work for your situation. This might include small business opportunities or part-time work that fits your schedule and abilities. Community support programs offer another valuable resource during this transition. These programs often provide practical help and connect families with services they might not know about. Getting involved with local community initiatives can open doors to new opportunities and support networks. Taking these steps helps families deal with the financial challenges that come with policy changes. The goal is to build a more stable financial foundation that doesn’t depend entirely on social grants. This approach takes time and effort but leads to better long-term security for your household.

– Reach out to SASSA offices or trusted financial advisors for accurate guidance based on your individual case.

– Exploring alternative income streams can provide your household with greater financial flexibility.

– Review your existing skills, experience, or assets that could be turned into additional earnings.

– Participating in community programs helps you connect with others in similar situations and gain access to shared support and practical knowledge.