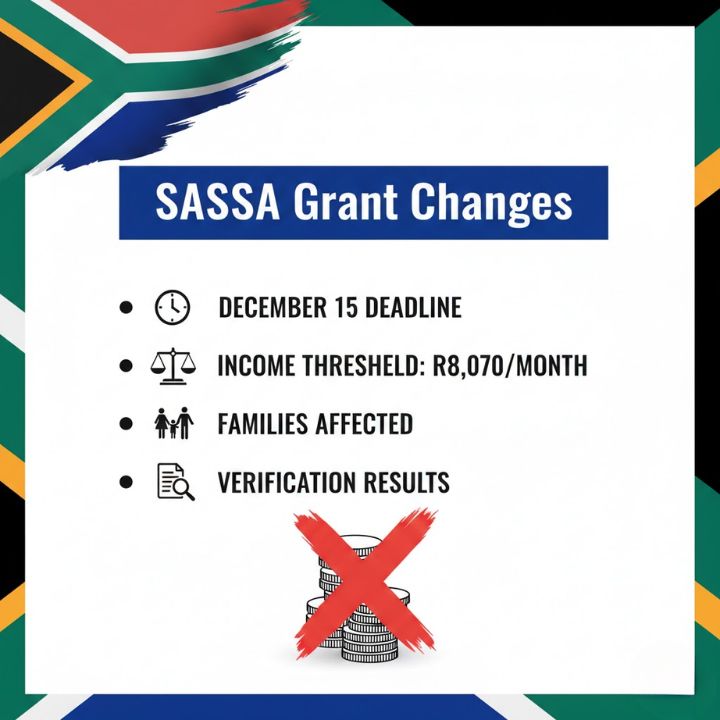

The South African Social Security Agency (SASSA) has announced a significant deadline that will affect numerous families across South Africa. The agency will discontinue grant payments to families with monthly earnings exceeding R8070 by December 15. This measure forms part of a broader initiative to enhance the social assistance system and ensure that support reaches those who genuinely require it. The adjustment holds considerable significance for many households that rely on this financial aid during challenging economic periods in the country. SASSA is implementing these changes to align social welfare programs with present economic conditions & guarantee that assistance benefits the most vulnerable citizens. Families whose income surpasses the threshold should begin exploring alternative financial management strategies before the deadline.

Why SASSA Will Stop Payments for Families Earning Above R8,070 in South Africa

The South African Social Security Agency has made the decision to end payments for families who earn more than R8070 each month. This marks a significant shift in the way the agency manages social welfare funding. The move is designed to improve the use of available resources by channeling them toward families with the greatest need. SASSA aims to ensure that financial support goes to the poorest households instead of being distributed across families with higher earnings. The agency considers this strategy will create a more sustainable social grant system in the long run. By concentrating on lower-income families the organization seeks to combat poverty more efficiently & ensure that vulnerable individuals receive the assistance they need.

UK £600 DWP Cost of Living Relief for 2025 : New Rules, Full Schedule and Other Details Here

UK £600 DWP Cost of Living Relief for 2025 : New Rules, Full Schedule and Other Details Here

– The policy aims to do more than just cut down the number of people receiving benefits.

– It tries to align welfare programs with the current state of the economy while ensuring that funds will still be there for people in the future.

– SASSA wants families who earn more than the set limit to stand on their own feet financially instead of depending on government help.

– This approach focuses on supporting people who struggle the most with money problems.

– The agency thinks that setting an income limit for grants will make the system fairer & help those South Africans who need it most.

– The change shows an attempt to spend public money wisely while still helping people who cannot get by without support.

How the December 15 SASSA Cutoff Affects South African Families Financially

SASSA Payment Changes and Their Effects on South African Households The decision to stop payments will affect many South African families who currently receive social grants. People who earn slightly more than R8070 may face financial uncertainty because of this change. Families who are affected need to look for other ways to manage their money. When the payments stop households will need to review their budgets & decide what their financial priorities should be. However this change might also help reduce how much wealthier families depend on government support. It could push them to become more self-reliant and financially independent. SASSA’s new policy is a signal for families to rethink how they handle their finances as economic conditions change.

| Income Bracket | Expected Impact | Required Step | Likely Result |

|---|---|---|---|

| Below R8,070 | Uninterrupted SASSA benefits | No action needed currently | Regular grant payments continue |

| R8,070 – R10,000 | Possible pause in grant | Review income & expenses | Reduced dependency on support |

| Above R10,000 | Grant eligibility removed | Explore new financial options | Shift toward self-managed income |

Checklist: How to Prepare for the Upcoming SASSA Payment Block

Families affected by SASSA payment changes should prepare themselves before December 15. These households need to review their financial situation and consider alternative income sources. Being prepared involves understanding what the policy change actually involves and how it will impact them. Families must assess their current financial position & identify areas where they can reduce expenses. They should also explore opportunities to generate additional income. Consulting with a financial advisor could be beneficial during this transition. This situation offers families an opportunity to improve their money management skills and utilize their resources to maintain financial stability after SASSA payments end.

– Begin by reviewing your existing financial plans.

– Consider various income-generating options.

– Examine your expenses and identify areas for reduction.

– Seek guidance from financial professionals.

– Search for opportunities to increase your earnings.

What Families Should Do After the SASSA Deadline Hits

Families affected by SASSA’s payment suspension should take practical steps to adapt to the new policy. Begin by understanding what the policy involves and how it impacts your household finances. Reach out to SASSA directly for accurate information & guidance about your specific circumstances. Focus on developing financial skills such as budgeting and saving money. Research community programs and support networks in your area that can provide assistance during this transition.

– These actions will help families minimize the impact of the policy change and develop stronger financial management practices for the future.

– Understand how the new policy affects your situation and contact SASSA for reliable information.

– Work on improving your budgeting and saving abilities while exploring local support programs.

– Establish sustainable habits for handling your finances effectively.

Free Community Programs Now Supporting Families Losing SASSA Payments

Community support programs provide valuable assistance to families experiencing interrupted SASSA payments. These programs offer additional resources and connections that help families navigate financial difficulties more effectively. Local community centers and non-profit organizations typically operate programs that include financial education and job training alongside other beneficial services. By participating in these programs families can develop practical skills & access resources to improve their financial circumstances. Affected families should seek out these community resources and incorporate them into their adaptation strategy.

– Financial literacy programs provide education on money management principles.

– Job training and employment services assist people in finding work & developing new skills.

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

– Financial advisors offer families professional guidance on managing their finances.

– Community support groups enable families to connect with others experiencing similar challenges and exchange experiences.

Top 5 Income Alternatives to Replace SASSA Support in South Africa

Finding Alternative Income Sources During SASSA Payment Delays When SASSA payments experience delays families must search for alternative income opportunities. South Africa offers various options for people seeking additional earnings. Starting a small business or pursuing freelance & part-time work are viable choices. The internet provides opportunities for remote work and online service provision. Families should evaluate their skills & interests to identify suitable income-generating activities. Having multiple income streams reduces dependence on social grants. This strategy helps families establish better financial stability for the future.

– Steps to Consider Assess your existing skills and personal interests.

– Research small business opportunities that align with your capabilities.

– Look for freelance work or part-time positions available locally.

– Explore internet-based work options and services you can offer remotely.

– Develop a strategy that generates income from multiple sources.

Smart Budgeting Tips to Maintain Stability Without SASSA Aid

Building a strong financial plan is essential for families transitioning away from SASSA assistance. Financial planning involves setting clear money goals and creating a budget that prioritizes saving. Families should focus on long-term financial stability by building emergency funds and planning for future expenses. Helpful resources such as budgeting applications and financial education workshops can support families in achieving these objectives.

– When families maintain consistent financial practices they can work toward sustainable independence and economic stability.

– Key steps include setting specific financial goals and developing a comprehensive budget.

– Families should prioritize savings and establish an emergency fund.

– Using budgeting tools and educational materials helps reinforce positive financial behaviors.

– Maintaining these practices consistently leads to greater financial security over time.

Wider Impact: What the New SASSA Income Rules Mean for the Economy

The economic impact of SASSA’s payment policy is significant for both individual households and the broader South African economy. The policy aims to reduce poverty and stimulate economic growth by directing resources to those most in need. However when payments abruptly end for families whose income has increased they often experience financial strain and reduce their spending on essential goods and services. The long-term success of this policy depends on how effectively affected families can adapt to these changes and whether they can secure alternative income sources. Understanding these economic consequences is essential for both policymakers & families to navigate this transition effectively.

| Economic Factor | Key Influence | Expected Outcome |

|---|---|---|

| Poverty Reduction | Targeted distribution of benefits | Enhanced protection for low-income households |

| Consumer Spending | Variation in daily expenditure patterns | Potential slowdown in retail and service sectors |

| Employment Market | Increased demand for job opportunities | Creation of new jobs and expansion of key sectors |

| Household Financial Stability | Better income security for vulnerable families | Stronger financial resilience across communities |

| Long-Term Economic Growth | Driven by effective policy implementation | Stable and sustainable national development |

Expert Tips for Families Affected by SASSA’s December 15 Payment Ban

Navigating SASSA Payment Changes: A Practical Guide for Families Families dealing with SASSA payment changes need to take practical steps to handle this shift successfully. The first priority is to understand exactly what the policy means and how it will affect your household finances. You can get helpful information by talking directly with SASSA representatives or consulting with financial advisors who know the system. The second important step is to look for other ways to earn money. Relying only on social grants can be risky when policies change. Think about different financial approaches that could work for your situation. This might include small business opportunities or part-time work that fits your schedule & abilities. Community support programs offer another valuable resource during this transition. These programs often provide practical help & connect families with services they might not know about. Getting involved with local community initiatives can open doors to new opportunities and support networks. Taking these steps helps families deal with the financial challenges that come with policy changes. The goal is to build a more stable financial foundation that doesn’t depend entirely on social grants. This approach takes time and effort but leads to better long-term security for your household.

– Key Actions to Take Understanding the policy and how it affects your payments is the starting point.

– Contact SASSA offices or financial advisors to get clear answers about your specific situation.

– Looking for additional income sources gives your family more financial options.

– Consider what skills or resources you already have that could generate extra money.

– Joining community programs connects you with others facing similar challenges & provides access to shared resources and knowledge.