When you turn 55 & think about taking that vacation or fixing up your home, you might wonder how much access you have to your CPF savings. In 2025 Singapore’s Central Provident Fund is making changes that affect more than four million members by balancing security with flexibility. These updates are not just paperwork but real support for older Singaporeans who want to manage their money better and plan for longer retirements. Whether you prefer withdrawing cash or setting up regular payouts understanding these new rules will help you make better financial decisions. Let’s take a closer look.

Age 55 — The Key Turning Point for Limited CPF Withdrawals

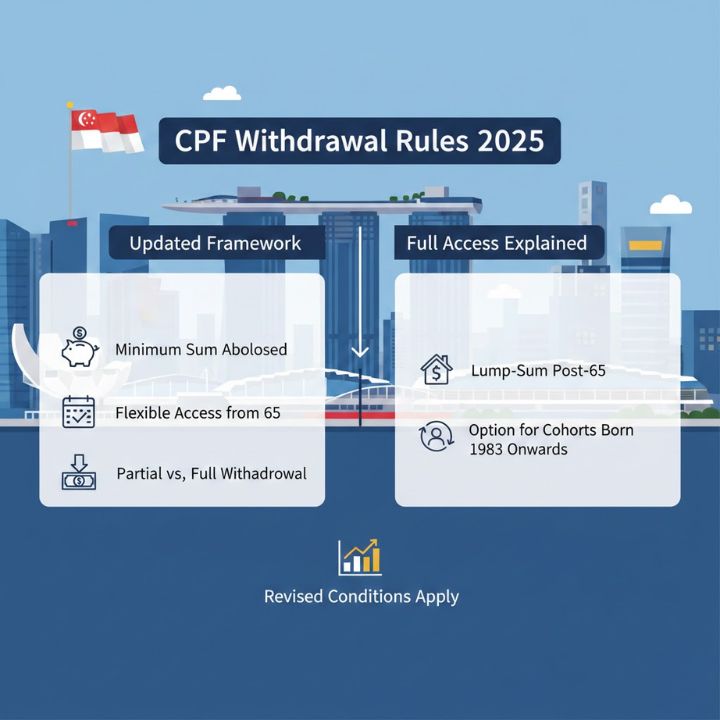

Turning 55 remains the key age for accessing CPF savings even though the official retirement age is gradually increasing to 64. When you reach 55 your Ordinary Account & Special Account combine into a Retirement Account that caps at the Full Retirement Sum of S$205,800. Any amount above this limit can be withdrawn immediately for unexpected expenses. If your balance falls below this threshold you can only withdraw up to S$5000 as a lump sum while the remaining funds stay in your Retirement Account for long-term security. A significant update for 2025 affects members aged 55 and older as their Special Accounts will close and any withdrawable portions will move to the Ordinary Account for simpler access. This arrangement encourages a balance between having money available now while protecting your future income stream.

Eskom's R16 bn Diesel Savings in December 2025: A Hopeful Sign for Lower Consumer Tariffs?

Eskom's R16 bn Diesel Savings in December 2025: A Hopeful Sign for Lower Consumer Tariffs?

Special Conditions That Allow Earlier or Additional Access

Life throws challenges at you and the CPF system recognizes this reality. If you become permanently disabled you can withdraw your funds by submitting medical documentation. The amount you receive depends on your account balance and how severe your condition is. Planning to leave Singapore for good? Both non-residents & former PRs can close their accounts and transfer the money overseas once they get approval. The system even gives you a 12-hour window to reconsider your decision. Housing support remains an option where you can tap into your Ordinary Account for buying or renovating property. Starting in 2025 the rules require you to return unused amounts to your CPF account faster to prevent money from sitting around doing nothing. These withdrawal options are not tricks or shortcuts. They are official pathways designed to help people access their retirement savings when genuine emergencies arise without completely destroying their long-term financial plans.

Retirement Sums Explained — How Your CPF Savings Are Structured

Retirement Sums form the foundation of the 2025 CPF rules & serve as benchmarks to safeguard your retirement years. These amounts are adjusted annually to account for inflation and determine how much money you need to set aside and what you can withdraw. If you choose to make a voluntary contribution up to the Enhanced Retirement Sum of S$426000 you can increase your monthly CPF LIFE payouts substantially to potentially reach S$3,330 when you turn 65. Statistics show that four out of five people who are 55 years old or older have already exceeded the Basic Retirement Sum which allows them some flexibility with withdrawals while still maintaining guaranteed lifetime payments. A practical suggestion is to use the CPF online calculator to explore different retirement scenarios & get a clearer picture of your financial future.

| Retirement Sum Category | 2025 Amount (S$) | Why It Matters |

|---|---|---|

| Basic Retirement Sum (BRS) | 106,500 | The baseline amount that supports monthly payouts from age 65. If you meet BRS, you can typically withdraw up to S$5,000 at age 55. |

| Full Retirement Sum (FRS) | 205,800 | Sets the usual cap for moving OA/SA savings into the Retirement Account (RA). Any savings above this level may be withdrawable at age 55 (subject to eligibility rules). |

| Enhanced Retirement Sum (ERS) | 426,000 | A higher target (about 4× BRS) designed to increase lifelong payouts. Commonly used by members who top up for stronger retirement income. |

Payout Options and Extra Benefits Under the 2025 Rules

After you turn 55 your attention moves to age 65 when CPP LIFE begins providing monthly payments for life. You can now choose to start these payments anytime between 65 and 70. The interest rates fall between 2.5% and 4% which beats what most banks provide. Those who wait longer to withdraw their money receive greater benefits. The 2025 reforms include an important warning about withdrawing funds too soon as this could mean losing your lifetime income stream. The better approach is to balance lump sum withdrawals with annuity payments while paying back housing-related amounts and adding extra contributions to maximize your retirement account.