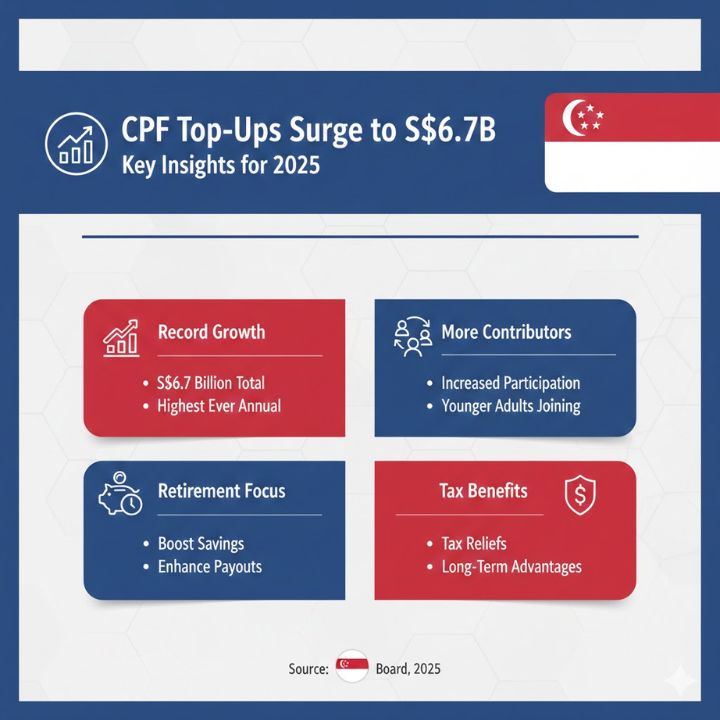

CPF top-ups have increased dramatically & you might have noticed more people talking about adding money to their accounts. Many Singaporeans are setting aside extra funds to boost their retirement savings. The CPF Board reported that voluntary top-ups reached S$6.7 billion in the first seven months of 2025. This amount has already exceeded the S$4.8 billion recorded for all of 2024. Here is a brief explanation of why this happened and what it means for members.

Comparing CPF Top-Ups: 2024 vs 2025 — A Quick Snapshot

| Category | 2024 (Full Year) | 2025 (First 7 Months) | Updated Insights |

|---|---|---|---|

| Total CPF Top-Ups | S$4.8B | S$6.7B | New all-time high contribution level |

| December Top-Ups | Approx. S$700M | S$2.9B | Over 4× surge in early-year contributions |

| Top-Ups by Seniors (55+) | Not recorded | S$2.6B | Significant boost driven by retirement planning |

| Members Receiving Top-Ups | Not recorded | 316,000 members | Includes both self and family top-ups |

| MRSS Beneficiaries | 103,000 | 130,000+ | Programme expanded to cover seniors aged 70+ |

What Drove the Surge in CPF Top-Ups in 2025?

Let’s break down the main reasons behind this huge spike. When you look closely, it becomes clear that policy changes—and Singaporeans reacting fast—played the biggest role.

Impact of the Increased Enhanced Retirement Sum (ERS) for 2025

Starting from 15 December 2025 the Enhanced Retirement Sum increased from three times the Basic Retirement Sum to four times that amount. This change allows members to contribute significantly more money to their Retirement Account so they can receive larger monthly payments in the future. A large number of people acted quickly on this opportunity. During December alone, top-up contributions reached S$2.9 billion. Out of this total, S$2.6 billion came from seniors who were 55 years old or older.

End of the Special Account for Members Aged 55+: What Changes Now?

Another major change occurred on 19 December 2025 when the Special Account was closed for members aged 55 and above. What followed was predictable. Members rapidly moved their savings from their Ordinary Account into their Retirement Account to benefit from better long-term interest rates rather than keeping the money at lower Ordinary Account rates. This shift produced a temporary spike that substantially increased the figures for 2025.

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

Rising Senior Contributions Through the Matched Retirement Savings Scheme (MRSS)

The MRSS has been one of the most important programs for older adults who need assistance growing their retirement funds. In 2025 the program saw significant increases in participation for two main reasons. First the scheme now includes seniors over 70 years old. Second the yearly matching grant rose to S$2,000. More than 130000 members have received MRSS top-ups this year which exceeds the total number from all of 2024. Around 54% of these members are over 70 years old. Most MRSS participants contributed S$2,000 or more to get the full matching grant. In fact 74% of them chose to maximize their benefits this way. When older Singaporeans discuss topping up their accounts before potential changes occur they are making a practical decision based on these incentives.

How These Shifts Affect Everyday Singaporeans

Even if you’re not topping up right now, these numbers show a big shift in how Singaporeans think about retirement.

Key Groups Benefiting the Most From the 2025 CPF Boost

Rewritten Text Members who top up their CPF accounts early benefit from interest rates between 4% and 6% that exceed typical bank returns. This strategy leads to larger CPF LIFE payouts during retirement. Rising Interest in CPF Returns Finding risk-free investments that offer 4% to 6% interest has become increasingly difficult in today’s market. As the cost of hawker meals and daily necessities continues to climb, more people recognize the value of securing stable and competitive returns through their CPF accounts. Family Members Support Each Other Through Top-Ups Among the 316,000 members who received CPF top-ups many contributions came from their relatives. Adult children are increasingly helping their elderly parents by making these contributions. The Matched Retirement Savings Scheme (MRSS) has made this option particularly appealing since the Government doubles the contribution amount.

Early Retirement Planners: Why 2025 Is a Turning Point

Seniors Aged 55 & Above

– They are the biggest group topping up because the SA closure pushed them to move funds.

– The ERS jump allowed larger top-ups. They want higher lifelong payouts.

Low-Balance Seniors: Bigger Opportunities for Retirement Growth

Younger members do not make up the largest group but many have begun contributing extra money for their parents through MRSS to get the matching grant. Low-balance seniors have gained new opportunities through the MRSS expansion. Older Singaporeans including those in their 70s now have a chance to increase their retirement savings with help from the Government.