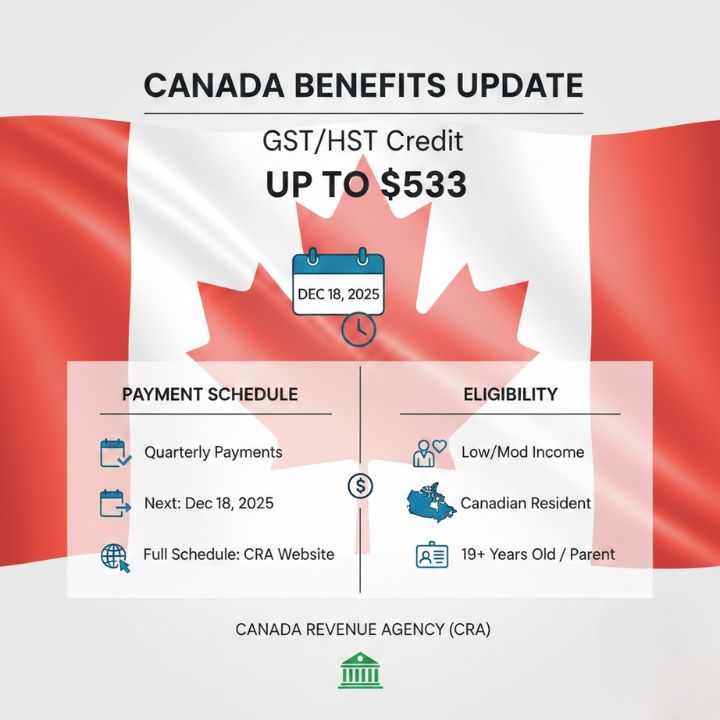

Canada Revenue Agency Confirms December 2025 GST/HST Credit Payment Date The Canada Revenue Agency has announced that GST/HST credit payments for late 2025 will arrive on December 14th 2025. This payment will help eligible Canadians manage rising living expenses. The December payment can reach up to $533 for qualifying individuals & families as part of the quarterly federal tax-free credit program that helps offset the GST & HST paid on everyday purchases. This article covers everything you need to know about eligibility requirements and payment amounts. You will learn who qualifies for the maximum benefit and how to make sure your direct deposit arrives on schedule.

What Is the CRA GST/HST Credit in 2025? A Simple Breakdown for Canadians

The GST/HST credit is a tax-free payment that the government sends out four times a year. It helps Canadians with low and modest incomes cover the sales taxes they pay on everyday purchases. The credit amount is figured out automatically each year when you file your income tax return. You don’t need to fill out a separate application form to receive it. As long as you file your taxes on time the government will calculate whether you qualify and how much you should get. This benefit exists because consumption taxes like GST & HST affect lower-income households more heavily. Since everyone pays the same tax rate on purchases regardless of their income level these quarterly payments help balance things out for those who need it most.

Top Highlights of the 2025 GST/HST Credit You Should Know

The CRA pays this benefit every three months. You receive it tax-free so it will not change your income or affect other benefits you get. The money helps families pay for basic living expenses. The government sends it automatically either through direct deposit to your bank account or by mailing you a cheque. The payment on December 15 2025 will be the last big deposit for the year.

Why the December GST/HST Payment Is Crucial for Low-Income Households

The December GST/HST credit is important because it comes just before people begin their holiday shopping and face increased heating costs during winter. These expenses make this period one of the most costly times of the year for Canadian families. Rising inflation keeps pushing up prices for food housing and transportation, so this payment provides valuable help with household budgets. Many families also get adjusted payment amounts that reflect the income details from their latest tax return.

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

Who Qualifies in 2025? Complete Eligibility Rules for GST/HST Credit

The CRA uses your 2024 tax return to determine if you qualify. You must file taxes to get the credit. General Eligibility Requirements To qualify for the GST/HST credit you need to meet these conditions: –

Be 19 years old or older unless you have a spouse or common-law partner or you are a parent who lives with your child

– Be a Canadian resident for tax purposes

– Have a household income in the low to modest range according to CRA guidelines

– Have filed your 2024 tax return Who Can Qualify

– Single adults earning lower incomes

– Seniors with modest pension income

– Families with children

– Newcomers who have lived in Canada for at least 12 months

– Part-time or seasonal workers

– People who receive other federal benefits like the carbon rebate or disability tax credit

$533 GST/HST Credit Explained: How Much You Can Really Get

# GST/HST Credit Payment Amounts Your payment amount depends on your family size and net income. The maximum payment of $533 is the standard combined amount that eligible recipients get during this payment period. What You Will Receive The CRA calculates your exact payment using your tax information. Here is how it works: Single individuals get a basic amount. Couples receive an additional amount. Each child under 19 increases your payment. Lower income families get higher payments. The CRA calculates your payment automatically and updates it each July based on your latest tax return.

CRA GST/HST Credit Payment Timeline: All December 2025 Dates

GST/HST Payment Amounts Your payment amount depends on your family size and net income. The maximum payment of $533 is the standard combined amount that eligible recipients get during this payment period. How Much You Will Receive The CRA calculates your exact payment using your tax information. The payment structure works as follows: Single individuals receive a base amount. Couples get an additional amount added to the base. Each child under 19 increases your total payment by a set amount. Lower income families qualify for higher payments. The CRA calculates your payment automatically and adjusts it each July based on your latest tax return.

How to Ensure Your GST/HST Credit Arrives On Time

The CRA has announced that the final 2025 GST/HST credit will be deposited on Thursday December 04 2025. If you have direct deposit set up most people will get their payment on the same day. Direct deposit is the quickest and most dependable way to receive your funds. If you do not have direct deposit you will get a cheque in the mail instead. It might take up to 10 business days for the cheque to reach you depending on where you live. If December 04 happens to be a bank holiday or there are delays in your area you might receive your payment on the next business day instead.

Does the GST/HST Credit Affect Other CRA or Government Benefits?

1. Check That Your Direct Deposit Details Are Correct Most payment delays happen because of incorrect bank information. You can update your details through CRA My Account or by using your bank’s direct deposit enrollment service. 2. Submit Your Tax Return Each Year The CRA cannot send you GST/HST credits if you don’t file your taxes. They need your income details to determine if you qualify for the payment. 3. Update Your Mailing Address If you receive paper cheques instead of direct deposit make sure the CRA has your current address on file. 4. Check CRA My Account Regularly Your CRA online account shows your payment status & explains your eligibility. You can also find answers about your benefits there.

GST/HST Payment Not Received? Immediate Steps to Fix the Issue

If your payment does not arrive on December 14th or the next business day you should follow these steps. First make sure your direct deposit information is accurate. Then look at your CRA My Account to check for any holds or updates. You should wait at least five business days before contacting the CRA about this problem. If you get payments by cheque you need to wait ten business days before reporting it as missing. The December 14th 2025 GST/HST credit payment offers up to $533 in financial help for millions of Canadians facing higher living costs. This federal program sends tax-free payments every three months and automatically qualifies low-income households without needing extra applications. This makes it one of the simplest government benefits to receive. You can ensure your payment arrives on time by filing your tax returns and updating your details with the CRA. This payment can help you handle your expenses as the year ends.