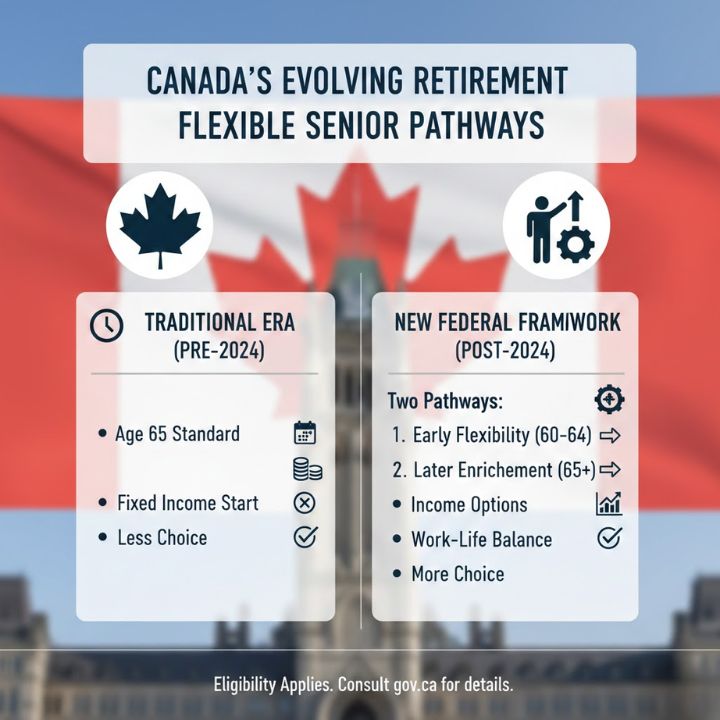

Canada’s retirement system changed dramatically in 2025 with reforms that give people more control over when & how they retire. The government eliminated the mandatory retirement age of 65 and created a flexible system where Canadians can choose retirement timing based on their own financial situation and personal preferences. The new framework offers two main paths: early retirement for those who want to stop working sooner and deferred retirement for those who prefer to work longer. This updated system acknowledges that Canada’s population is aging and that older workers have different needs and expectations than previous generations. The reforms move away from a one-size-fits-all approach and instead let individuals design retirement plans that match their unique circumstances. Seniors can now make decisions about pension benefits that align with their health status and financial goals. The changes matter for everyone involved in retirement planning.

Ending the Mandatory Retirement Age of 65: A Landmark Shift

For many years age 65 has been the standard point when Canadians moved from working full-time to retirement. In the previous system Canadians usually started receiving Canada Pension Plan and Old Age Security benefits at this age. As of December 2025 the Canadian government has removed the mandatory retirement age of 65 and created opportunities for a more flexible and personal approach. This change allows people to decide when they leave work & begin receiving pension benefits. Retirement is no longer based on a fixed age but can now match individual situations including career satisfaction & health status and financial objectives.

Implications for Workers and Employers

Under the revised rules employers cannot force employees to retire just because of their age. This change improves job opportunities for older Canadians and helps workplaces appreciate experience and skills from workers of all ages. Employees who want to keep working can do so without worrying about being forced out while those who prefer to retire early can make that choice knowing how it affects their benefits. For many Canadians this shift means having freedom and control over their lives after full-time work. It lets people make retirement decisions based on their own priorities instead of following what society expects.

Two New Retirement Options: Early and Deferred Choices

2025 Pension Reform Pathways The 2025 reforms create two main ways for seniors to collect their pension benefits: early retirement and deferred retirement. These choices provide a customized approach that fits different financial needs and work preferences & personal lifestyles. Early Retirement Option Seniors can now choose to retire before reaching the standard retirement age

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

Early Retirement Option: Claiming Benefits Before 65

Seniors can now retire before turning 65 years old. This choice lets Canadians start getting CPP and OAS payments earlier than usual. However there is a downside because the monthly amounts will be smaller. The government reduces these payments since they will be paid out over a longer time period. This early retirement option works well for people who want to leave their full-time jobs sooner. Some choose this path because of health problems while others need to take care of family members. Many simply want more time to enjoy hobbies & personal interests. The smaller monthly payments do mean less money over the years. Still this approach gives freedom to those who value life experiences & personal happiness more than getting the highest possible income.

Deferred Retirement Option: Extending Work Beyond 65

Canadians can also keep working after age 65 and wait to claim their pension benefits. When they do this their monthly CPP and OAS payments go up as a reward for waiting longer. This happens because they keep contributing to the workforce & because the government will pay out benefits for fewer years. This option works well for seniors who are healthy and can continue working. It gives them more income when they reach their later retirement years. People who want the best financial security often find that delaying retirement helps a lot. This strategy works even better when they also keep adding money to workplace pensions or their own retirement savings accounts.

Tailoring Retirement to Individual Needs

The flexibility that comes with these two options allows Canadians to align their retirement timing with their own personal situations. Some people might want to retire early so they can enjoy more years of leisure time. Others might decide to keep working longer because they want to improve their financial security. The new system works well for both of these situations. This makes retirement something people can plan in a way that fits their own needs and goals better.

Motivations Behind the Retirement Reform

Canada’s retirement policy changes stem from several important factors that connect to population trends & economic conditions.

Demographic Shifts and Longer Life Expectancy

Canadians now live longer & stay healthier than earlier generations. With life expectancy rising the standard retirement age of 65 no longer matches how long people remain active. The government eliminated mandatory retirement because many seniors can and want to work past 65. This makes retirement planning a flexible lifelong process instead of something that happens at a set age.

Economic and Social Considerations

Canada faces challenges common to developed countries including an aging population & fewer workers. These patterns strain public pension systems and social services while affecting the overall economy. The government encourages older Canadians to keep working to ease pressure on public pensions and maintain economic stability.

Modernizing the Retirement Framework

The reforms also reflect changing social expectations beyond just demographics and economics. Modern workers want independence and flexibility in their choices. Retirement planning today goes beyond reaching a certain age and collecting benefits. It involves blending work with financial decisions & lifestyle preferences to support overall quality of life.

Impact on Canada Pension Plan and Old Age Security

The reforms directly affect two core pillars of Canada’s retirement system: the Canada Pension Plan and Old Age Security.

Changes to CPP Benefits

– The CPP provides monthly taxable retirement benefits based on contribution history. As of January 2026 the maximum CPP benefit at age 65 was approximately $1433 per month. Actual amounts vary depending on an individual’s work and contribution record.

– Under the new rules early retirement reduces monthly CPP payments to account for a longer payout period.

– Delaying retirement beyond 65 increases monthly CPP benefits through enhanced credits.

– Continued contributions past 65 can further boost overall pension income.

Adjustments to OAS Payments

The OAS program works in a similar way with the flexible retirement system. Older adults who wait to claim OAS benefits after turning 65 will get higher monthly payments. Those who claim early will receive somewhat smaller amounts. These changes help keep benefits sustainable over time and encourage people to wait before claiming.

Comparing Retirement Options Under the New Rules

| Feature | Early Retirement (Before Age 65) | Standard Retirement (Around Age 65) | Deferred Retirement (After Age 65) |

|---|---|---|---|

| Pension Start Age | Begins before turning 65 | Starts at age 65 | Begins after age 65 |

| Monthly Benefit Level | Lower payments due to longer duration | Regular standard payments | Higher payments for delayed start |

| Work Status | May fully stop working | Usually exits workforce | Can continue employment |

| CPP Contributions | Contributions end at retirement | Contributions stop at retirement | Contributions continue, boosting benefits |

| Overall Financial Impact | Lower lifetime monthly income | Balanced and average payout | Higher monthly income over time |

Additional Considerations for Canadians

Most Canadians will still retire around age 65 but the new flexible options mean people can now choose retirement timing based on their health situation and financial circumstances & work preferences. Changes in the Workplace Companies need to update their policies for older employees who want to keep working. This might include adjusting workspaces for comfort and offering flexible hours and creating part-time or contract positions for seniors. Keeping experienced workers on staff helps both the company & the employees. Keeping the System Stable The government plans to gradually raise CPP contributions for new workers beginning in 2025 to keep the pension system working properly as people live longer. These changes will help future retirees get enough income while keeping the whole system financially sound. Creating Your Own Retirement Plan Canadians can now design retirement plans that fit their personal situations. When to retire depends on factors like health and job satisfaction and family needs and money goals. Learning about the benefits & drawbacks of retiring early versus later helps people make smart choices that improve both their finances & their overall happiness.

Conclusion: A New Era in Canadian Retirement

Canada’s 2025 retirement reforms represent a major shift in how older adults think about leaving the workforce. The government has removed the mandatory retirement age of 65 & introduced options for both early and delayed retirement. This new system puts individual choice first while promoting financial flexibility & long-term stability. The reforms acknowledge that people are living longer and staying healthier. They also recognize the need for economic security and the contributions that experienced workers bring to today’s economy. For Canadians getting ready to retire these changes create fresh possibilities to match their work plans & financial strategies with what they want from life. The result is a retirement that can be both personally satisfying and financially stable.