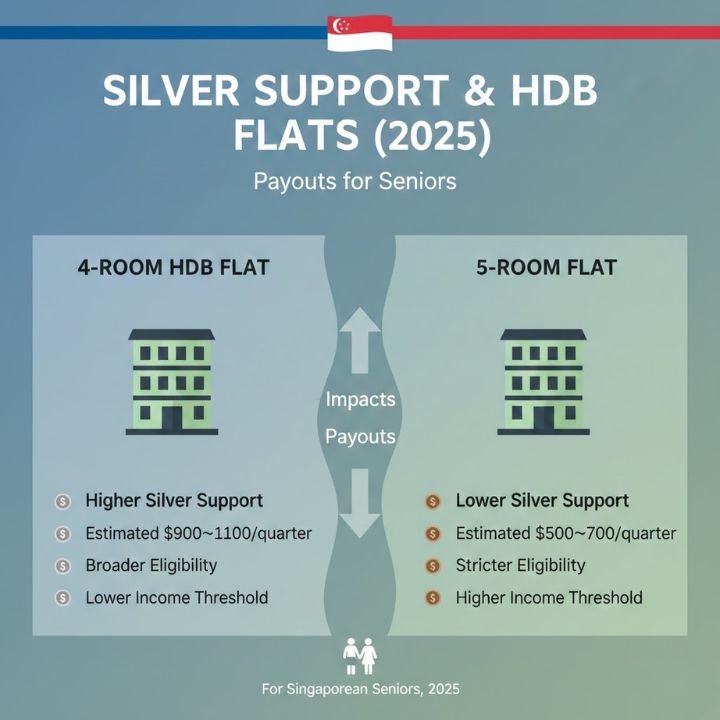

HDB Type Affects Your Silver Support Payouts Many seniors across Singapore often wonder why two neighbours of the same age receive different Silver Support payouts. You might hear this question at the kopitiam: “Why does he get more than me?” The answer is straightforward: your HDB flat type plays a significant role. The Silver Support Scheme provides quarterly cash support to seniors aged 65 and above who earned lower incomes during their working years. However, income records alone do not always reflect your actual financial situation. Because of this the government uses housing type as an indicator to determine how much assistance you might need.

2025 Silver Support Breakdown: 4-Room vs 5-Room at a Glance

| HDB Flat Category | Revised Quarterly Payout (2025) | Support Level | Reason for Variation |

|---|---|---|---|

| 4-Room Flat | $500 – $550 | Mid-Tier Support | Classified as a moderate-value property, hence mid-level payout |

| 5-Room / Executive Flat | $260 – $290 | Base Tier Support | Higher assumed property value and greater potential for monetisation |

How Your HDB Flat Type Influences Silver Support Eligibility

The program works on a straightforward basis. A smaller apartment means fewer possessions and therefore more assistance.

When you live in a 1-room or 2-room apartment the system considers you more likely to require substantial financial help. These older residents usually qualify for the top benefit level and receive payments that can exceed $900 each quarter in 2025 depending on official updates. When you live in mid-sized or larger apartments the assistance begins to decrease and sometimes the reduction is significant.

Room Flats: The Mid-Tier Category That Still Qualifies Many Seniors

Most Singaporeans live in 4-room flats and this is where we get the most questions. Seniors in 4-room flats typically get a medium level of Silver Support. For 2025 the estimated quarterly payment is about $480 to $530. The government sets this amount because they assume you have moderate financial stability. You don’t have as few assets as someone in a 1-room flat but you also don’t have as much financial cushion as someone in a 5-room home. If you are watching your spending carefully because hawker food costs more and utility bills keep rising then this amount can still help.

Room & Executive Units: Why These Receive the Lowest Support Tier

Here’s the part that catches many seniors off guard. If you live in a 5-room flat your quarterly payout drops significantly to around $240 to $265. The reasoning behind this is simple. A larger home typically means you own more valuable assets. This suggests you might be able to rent out a room or downsize to a smaller flat or access your property’s value if necessary. Of course this doesn’t reflect everyone’s reality. Many seniors prefer to age in the home they’ve lived in for decades. But the payout system still follows this logic regardless.

Key Property Ownership Rules That Often Disqualify Seniors

Flat type is not the only factor that determines eligibility. Your property ownership situation can also make you completely ineligible.

– Private property ownership disqualifies you You cannot be eligible if you or your spouse owns any private property. This includes condominiums, landed homes or properties located overseas.

– Multiple property ownership is not allowed Owning more than one property makes you ineligible. This rule applies to shophouses, additional flats and mixed-use units. The second property does not need to generate income for you to be disqualified.

– Income requirements apply Living in a 4-room flat does not guarantee eligibility. Your household income per person must meet the official 2025 requirements, which typically range from $1,800 to $2300. Exceeding this income limit will disqualify you from the program.

What These Housing Rules Mean for Seniors Planning Their Finances

If you are thinking of upgrading or helping your children take over a bigger flat you should remember this. A larger home can reduce your Silver Support benefits. The scheme runs automatically and no application is needed but your eligibility is reviewed yearly. That means any change in your housing status can affect your next payout.