Canada’s Retirement System Changes in 2025 Canada’s retirement system is entering a new phase in 2025 as CPP 2.0 takes full effect for millions of workers and retirees. This enhancement to the Canada Pension Plan brings higher contribution limits and increased retirement payouts along with long-term income security adjustments. These changes matter whether you are approaching retirement or just starting your career because they will affect your financial planning.

Understanding CPP 2.0: Canada’s Enhanced Pension Shift Explained

CPP 2.0 is not a replacement for the original Canada Pension Plan but an enhancement designed to increase retirement income. The goal is simple: allow Canadians to replace a larger portion of their pre-retirement earnings through CPP alone. This shift responds to rising living costs, longer life expectancy, and reduced access to workplace pensions.Unlike previous years, the 2025 changes represent a key milestone where the enhanced contribution structure and benefit calculations are fully in effect.

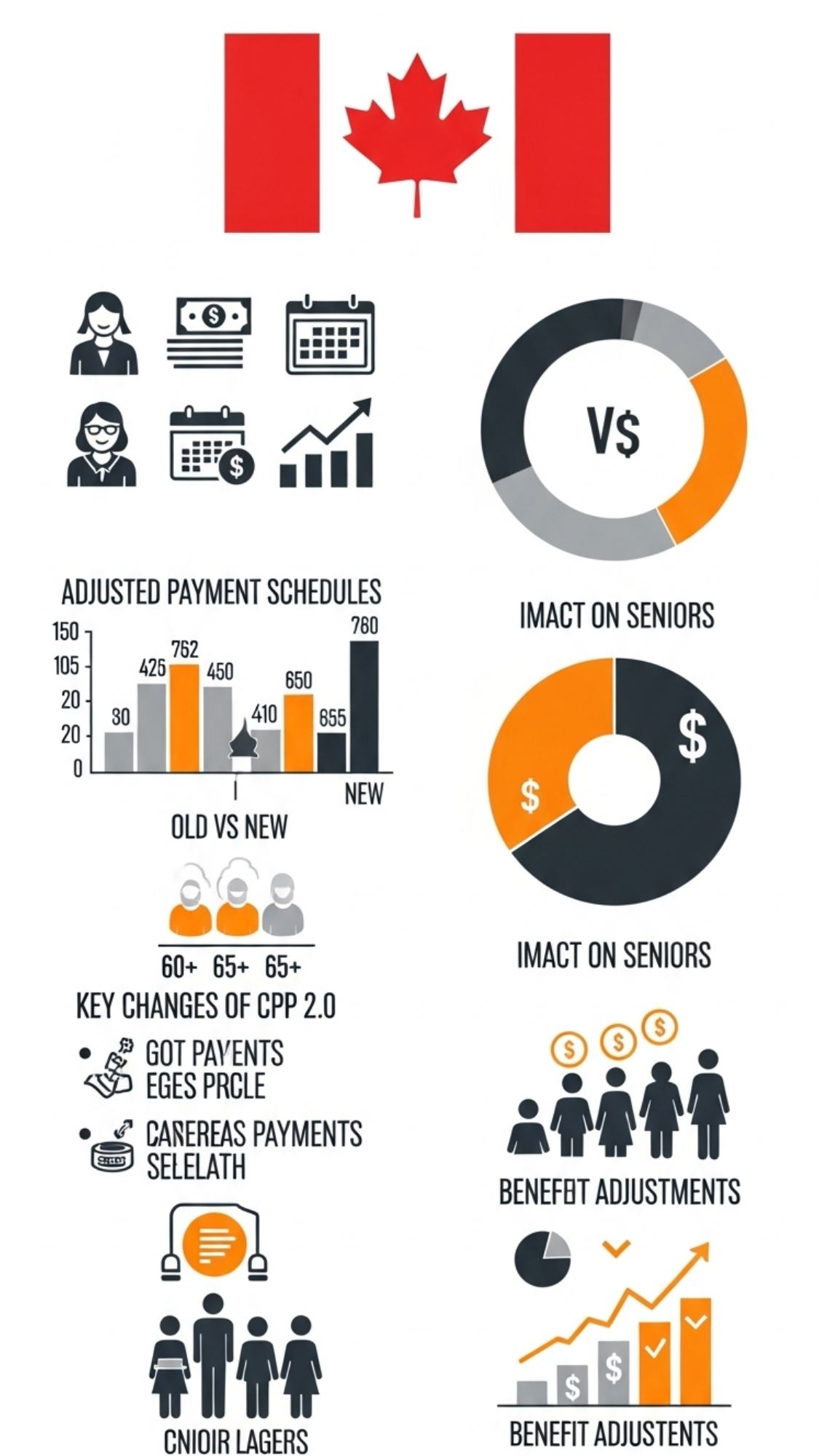

Revised CPP Benefit Amounts for Seniors Aged 60+ in 2025

One of the biggest changes for 2025 is the increase in monthly CPP retirement payments. The maximum CPP payment at age 65 will rise to about $1430 per month due to higher contribution levels. Keep in mind that most Canadians will get less than this maximum amount. Your actual CPP payment depends on how much you earned during your working years and how many years you contributed & the age when you start collecting CPP. People who earned higher incomes consistently & contributed for longer periods will benefit most from CPP 2.0.

CPP Payment Frequency Confirmed: Monthly Deposits Continue

The CPP payment schedule has stayed the same. Payments go out once each month and typically arrive close to the end of the month. Retirees who use direct deposit will keep getting their money automatically. Those who receive cheques need to account for additional mailing time. The change involves how the system calculates and indexes those payments. CPP benefits still get adjusted for inflation every year. This protects what retirees can buy as the cost of living goes up.

CPP 2.0 Contribution Framework: What Has Changed and How It Works

CPP 2.0 introduces a two-tier contribution system:

Updated YMPE and Income Thresholds Affecting Contributions

This applies to earnings up to the Year’s Maximum Pensionable Earnings (YMPE). Both employees and employers contribute equally, while self-employed Canadians pay both portions.

CPP 2.0 Eligibility Criteria: Age, Contributions, and Qualification Rules

A new upper earnings limit means that people who make more money will contribute extra amounts on income above the YMPE. These additional contributions will directly boost their future retirement benefits instead of working like a tax. Many workers will see slightly higher deductions on their pay stubs in 2025. This change will be most noticeable for those who earn above the average wage.

Key Updates for Existing CPP Beneficiaries and Retirees

The Year’s Maximum Pensionable Earnings goes up each year to match rising wages. CPP 2.0 adds a second earnings limit that lets people with higher incomes build bigger pensions. This update helps professionals and skilled workers who used to hit the CPP contribution limit too soon each year. Self-employed people also benefit from this change.

CPP 2.0 Impact on Employers and Self-Employed Workers

Eligibility rules for CPP benefits remain largely unchanged:

You must be at least 60 years old to start CPP

You must have made at least one valid contribution

You can begin CPP anytime between ages 60 and 70

Starting early results in reduced payments, while delaying past age 65 increases your monthly benefit. CPP 2.0 enhancements apply automatically based on your contribution history—no reapplication is required.

Forward Planning Guide: Steps Canadians Should Take Now

If you are already receiving CPP benefits, you do not need to take any action. Adjustments tied to CPP 2.0 are applied automatically where eligible. However, the biggest gains are expected for those still contributing under the enhanced system.

For retirees on fixed incomes, inflation indexing remains crucial, helping offset rising costs related to housing, food, and healthcare.