As winter arrives and money gets tighter for families across the province, the Ontario Trillium Benefit continues to be a critical source of financial help for people with low and moderate incomes. The next OTB payment will arrive on December 10, 2025, at a time when families are dealing with expensive heating bills, higher food costs, & holiday spending. With inflation still putting pressure on Ontario households this monthly tax-free benefit has become more important than ever in helping people maintain their financial stability. New payment amounts that started in December 2025 mean eligible residents can now get up to $2,100 each year based on their family size, income level and location. The Ontario Trillium Benefit can help reduce essential living expenses whether you rent or own your home, whether you are a student, a senior or live in Northern Ontario. This detailed guide covers everything you should know about the program. It explains how the OTB functions who can qualify for it, the updated payment schedule for 2026, examples showing how much money you might receive, and the key steps you need to take to make sure your benefit payment arrives on time each month.

Ontario Trillium Benefit Explained: How the Provincial Credit Supports Eligible Residents

The Ontario Trillium Benefit is a monthly payment sent by the Canada Revenue Agency for the Government of Ontario. It combines three separate provincial credits into one regular monthly deposit. This makes it simpler for residents to manage their budgets and plan for ongoing costs like housing & heating and sales tax.

The OTB is not taxable so you do not report it as income and it will not impact other federal or provincial benefits you get. It is one of the few income supports that runs all year & gets updated annually based on inflation and your tax return information. Three Provincial Credits Combined Into One Monthly Deposit Instead of getting three different payments at different times during the year residents now get one combined deposit.

The OTB includes: Ontario Energy and Property Tax Credit (OEPTC) This credit helps renters and homeowners who deal with high property taxes or large energy costs especially during cold months. Northern Ontario Energy Credit (NOEC) Residents in Northern Ontario pay some of the highest heating and electricity costs in Canada. This credit gives extra support for those additional expenses. Ontario Sales Tax Credit (OSTC) This credit helps reduce the provincial portion of sales tax on everyday items which makes it especially useful for families with children and people on tight budgets. Your OTB amount for the 2025-2026 benefit year is calculated using your 2024 income tax return. This includes your income and family situation and housing costs and energy expenses.

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

Canada Lines Up 6 CRA Payments Before Christmas 2025 - Revised Deposit Dates and Updated Timelines

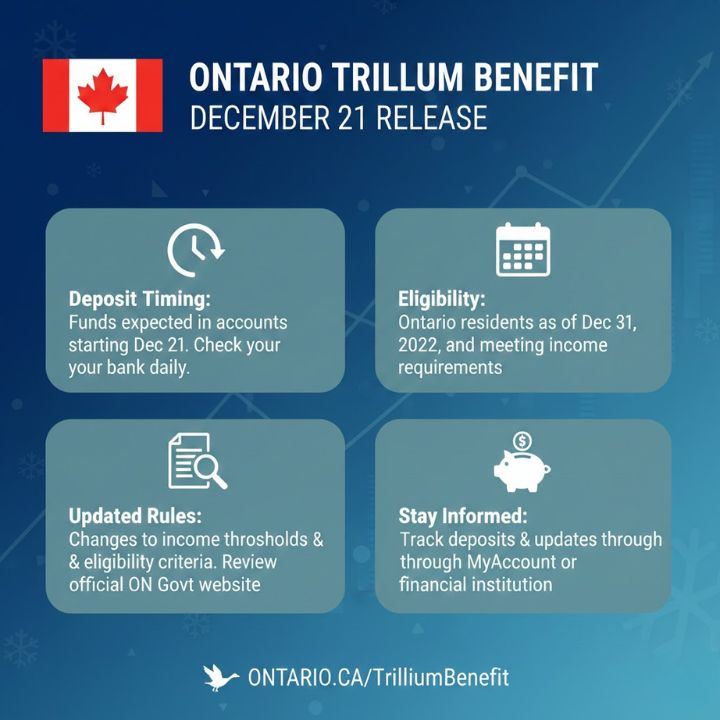

December 21 Ontario Trillium Benefit Release — Key 2026 Payment Dates to Watch

The following payment is scheduled for December 10 2025, with the 2026 payment schedule continuing after that. These monthly payment dates stay the same unless the province makes changes in December 2026. OTB Payment Dates for 2026 Payments are scheduled for January 9, February 10, March 10, April 10, May 8, and June 10 of 2026. People who qualified for $360 or less in total OTB benefits for the year received their full amount in one payment during December 2025. Anyone entitled to more than $360 gets monthly payments that run through June 2026. To receive payments on time, residents need to keep their direct deposit details, home address & marital status updated with the CRA.

Ontario Trillium Benefit Amounts: What Individuals and Families Could Receive

In December 2025 Ontario raised the amounts for all three parts of the OTB to help people pay for housing and energy costs. These new amounts are in effect for the entire 2025 to 2026 benefit year. Northern Ontario Energy Credit (NOEC) Single people can get up to 185 dollars while families can receive up to 285 dollars. This credit helps pay for the high heating and energy costs in areas like Sudbury, Thunder Bay, Sault Ste. Marie and other northern parts of the province. Ontario Energy & Property Tax Credit (OEPTC) Adults between 18 & 64 years old can receive up to 1283 dollars. Seniors who are 65 or older can get up to 1,461 dollars. People living in long-term care homes or on reserves can receive up to 285 dollars. Students living in eligible post-secondary housing can get up to 25 dollars. This is the biggest part of the OTB and helps both renters and homeowners with their costs. Ontario Sales Tax Credit (OSTC) You can receive up to 371 dollars for yourself. Your spouse or common-law partner can also get up to 371 dollars. Each child under 19 years old qualifies for up to 371 dollars. This credit is especially helpful for families with several children.

Annual Ontario Trillium Benefit Breakdown: Real-World Payout Illustration

To show how these three credits work together, look at a single person living in Northern Ontario who qualifies for everything. They would get 185 dollars from NOEC and 1,283 dollars from OEPTC and 371 dollars from OSTC. This adds up to 1,839 dollars per year in total OTB payments. Families with children receive much more money. A Northern Ontario family with two children could qualify for 371 dollars for the main recipient and another 371 dollars for their partner. They would also get 742 dollars for their two children and 285 dollars from NOEC. On top of that they could receive up to 1,461 dollars from OEPTC. These households can get more than 2100 dollars in annual OTB support based on their income and eligible expenses.

Monthly Deposits or One-Time Payment? Choosing Your Ontario Trillium Benefit Option

If your OTB entitlement exceeds 360 dollars you can choose between two payment options. You can receive monthly payments issued from December 2025 through June 2026 that provide steady income support throughout the year. Alternatively you can select a one-time lump-sum payment issued in June 2026 if you prefer receiving the full amount at once. Recipients with an annual entitlement of 360 dollars or less automatically received their complete payment in December 2025 without needing to choose a payment method. Most residents prefer monthly payments because this option helps them manage regular monthly expenses like rent and groceries and transit and utilities more effectively.

Ontario Trillium Benefit Eligibility Rules: Who Qualifies Under Updated Guidelines

Your eligibility for the OTB is based on your income and where you live and certain expenses you had in the previous tax year. Basic Requirements To get the 2025–2026 Ontario Trillium Benefit you need to be living in Ontario on December 31 2024 and have submitted your 2024 tax return. You also need a valid Social Insurance Number & must have paid qualifying rent or property taxes or energy costs during 2024. You can receive the benefit if you meet the requirements for any one of the three OTB credits. Ontario Sales Tax Credit Requirements You can get this credit if you are 19 years old or older or if you have a spouse or common-law partner or if you are a parent who lives with your child. Ontario Energy & Property Tax Credit Requirements You can get this credit if you paid rent or property tax or if you lived in a long-term care home or if you lived on a reserve and paid energy costs. Northern Ontario Energy Credit Requirements You need to live in Northern Ontario & have paid property tax or energy bills to qualify for this credit.

Temporary Residents and the Ontario Trillium Benefit: Where Eligibility Stands

Temporary residents like international students & workers with temporary permits do not automatically get the Ontario Trillium Benefit. Whether they qualify depends on their tax residency status & housing costs. Some temporary residents can qualify if they meet these conditions: They must have lived in Canada for tax purposes for 18 months & have a valid permit in the 19th month. They need to file a Canadian tax return and have a valid Social Insurance Number. They must have paid property taxes or rent or energy costs. They also need to meet the rules for at least one OTB credit. International students who rent an apartment & file taxes as residents may qualify for partial OTB payments if they have established long-term residential ties.

How Ontario Residents Receive the Trillium Benefit: Deposit Methods and CRA Setup

There is no separate OTB application available. The CRA automatically checks if you qualify when you file your tax return. Important Steps to Get Your Payment You need to file your annual tax return and complete Form ON-BEN. Make sure you report your rent & energy costs along with property tax details accurately. Setting up direct deposit will help you receive payments faster. You should also update your address and marital status whenever they change. If you forget to include the ON-BEN form you can fix your tax return by using the T1 Adjustment tool through your CRA My Account.

Maximizing Your Ontario Trillium Benefit: Smart Steps to Avoid Missed Payments

Understanding Your Tax Credits and Deductions Report all housing and energy expenses that qualify for tax benefits. Submit your tax return early in the filing season to prevent delays in processing. Select direct deposit as your payment method to receive refunds securely and quickly. Keep track of any changes in your income throughout the year since these variations might impact your eligibility for certain credits. Check the current credit requirements each year to make sure you claim every benefit available to you. Taking these steps helps you maximize your tax refund while avoiding common mistakes. Many taxpayers miss out on valuable credits simply because they don’t review the updated rules annually. Income changes from job switches or additional work can shift which credits you qualify for. By staying organized and informed about your expenses & earnings you can ensure the IRS processes your return smoothly and you receive all the money you deserve.